AMENDMENT TO THE COMPANY’S CERTIFICATE OF INCORPORATION

(PROPOSAL 1)

Description of the Securities ActCharter Amendment

Our Certificate of 1933, as amended,Incorporation currently allows us to issue up to 15,000,000 shares of common stock, par value $0.01 per share, and Section 21E15,000,000 shares of preferred stock, par value $0.01 per share. On December 12, 2023, our Board adopted resolutions approving, subject to stockholder approval at the Special Meeting, an amendment to our Certificate of Incorporation to increase the authorized number of shares of common stock to 30,000,000. The Board determined that the Charter Amendment is advisable and in the best interests of the Securities Exchange Act of 1934, as amended, which canCompany and directed that the proposed Charter Amendment be identifiedsubmitted for approval by the useCompany’s stockholders at the Special Meeting. The Charter Amendment does not affect the authorized number of forward-looking terminology such as “may,” “will,” “would,” “intend,” “could,” “believe,” “expect,” “anticipate,” “estimate” or “continue” or the negative thereof or other variations thereon or comparable terminology. Examplesshares of forward-looking statements, include, without limitation, those relatingpreferred stock. The proposed Certificate of Amendment to the Company’sCertificate of Incorporation (the “Certificate of Amendment”) reflecting the foregoing Charter Amendment is attached as Annex A to this Proxy Statement, and this discussion is qualified in its entirety by reference to Annex A.

If the Charter Amendment is approved by our stockholders, it will become effective immediately upon the filing of the Certificate of Amendment with the Secretary of State of the State of Delaware, which we expect to file promptly after the Special Meeting.

Purposes of the Charter Amendment

Our Certificate of Incorporation currently authorizes the issuance of 15,000,000 shares of common stock, par value $0.01 per share, and 15,000,000 shares of preferred stock, par value $0.01 per share. As of the Record Date, there were (i) [11,528,724] shares of common stock outstanding, (ii) 41,250 shares of Series A Convertible Preferred Stock outstanding, which are convertible into an additional [1,229,311] shares of common stock, (iii) 1,031,250 additional shares of common stock issuable upon the exercise of outstanding warrants, (iv) 350,000 additional shares of common stock issuable pursuant to our equity commitment agreement with affiliates of Conversant, (v) 601,617 additional shares of common stock available for issuance pursuant to our 2019 Plan, and (vi) 23,370 additional shares of common stock issuable upon exercise of outstanding stock options or settlement of RSUs. As a result, as of the Record Date the total number of shares of our common stock issuable on a fully diluted basis and after giving effect to the shares reserved for issuance under the 2019 Plan is approximately [14,764,272] shares, resulting in [235,728] shares available for future business prospectsissuances.

As previously announced, on February 1, 2024 we entered into the Securities Purchase Agreement with the Purchasers, pursuant to which the Purchasers agreed to purchase from us, and strategies, financial results, working capital, liquidity, capital needswe agreed to sell to the Purchasers, in the Private Placement, an aggregate of 5,026,318 Shares of our common stock at a price of $9.50 per share. The Private Placement will occur in two closings. At the first closing, which was completed on February 1, 2024, we issued and expenditures, interest costs, insurance availabilitysold an aggregate of 3,350,878 Shares to the Purchasers and contingent liabilities. Forward-looking statementsreceived gross cash proceeds of $31,833,341. At the second closing, which is anticipated to occur on or around March 31, 2024, we will issue the remaining 1,675,440 Shares to the Purchasers and receive additional gross cash proceeds of $15,916,680. As indicated above, after giving effect to the shares of our common stock that are outstanding and reserved for issuance, we currently do not have a sufficient number of shares of authorized and unissued common stock to complete the second closing of the Private Placement. Accordingly, the second closing is subject to certain risksour stockholders approving the Charter Amendment Proposal (in addition to other customary closing conditions) and uncertaintiesSecurities Purchase Agreement provides that could causewe will use our reasonable best efforts to obtain stockholder approval of the Charter Amendment Proposal at a meeting of the Company’s actual resultsstockholders no later than April 30, 2024. Each Purchaser has also agreed to vote all voting securities of the Company owned or controlled by such Purchaser in favor of the Charter Amendment Proposal. We are seeking approval of the Charter Amendment Proposal at this time to satisfy our obligations under the Securities Purchase Agreement, consummate the second closing of the Private Placement and financial conditionprovide us with flexibility to differ materially from those indicatedissue additional shares of common stock in the forward-looking statements, including, but not limited to:future.

6

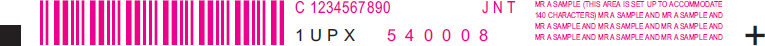

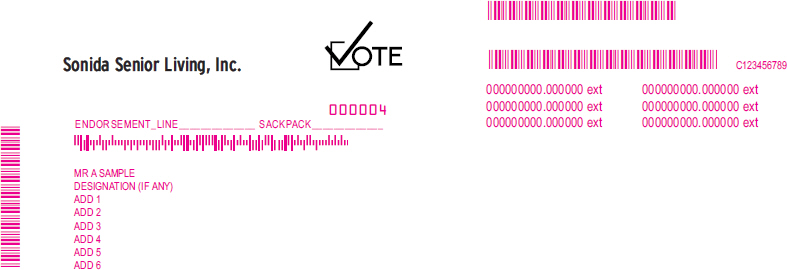

IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.